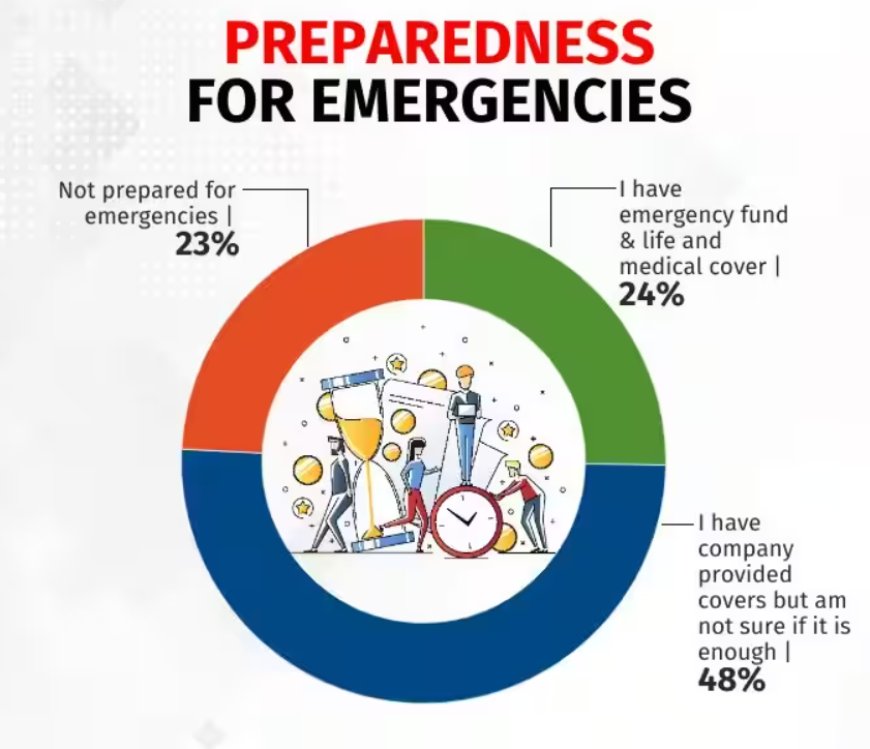

Financial Vulnerability Exposed: Survey Reveals 23% of Salaried Individuals Ill-Prepared for Emergencies

Alarming Survey: 23% of Salaried Individuals Lack Financial Preparedness for Emergencies

In a institution place financial security is superior, a current survey has clear up a concerning existence: a important portion of salaried things are unaware to handle economic emergencies. This upsetting disclosure influences into focus the significance of financial knowledge and the indispensable need for enhanced financial preparation between the trained workers. With 23% of scrutinized individuals wanting the essential safeguards, this item explores the causes behind this exposure and suggests potential answers.

The Survey:

Conducted by a famous financial research firm, the survey proposed to evaluate the fiscal preparedness of rewarded things across miscellaneous industries and pay supports. The study crossed various demographics and domains, including two together urban and country fields. The judgments were established a representative sample of 10,000 participants, making it statistically meaningful.

Financial Vulnerability Unveiled:

The survey unprotected a frightful revelation: almost a quarter of rewarded things, totaling 23% of the sample, were ill-adapted to handle fiscal dangers. This unit of the mathematical system raises concerns about the overall financial prosperity of things and the elasticity of the economy all at once. The reasons behind this exposure are versatile and implanted in several determinants.

1. Lack of Emergency Funds:

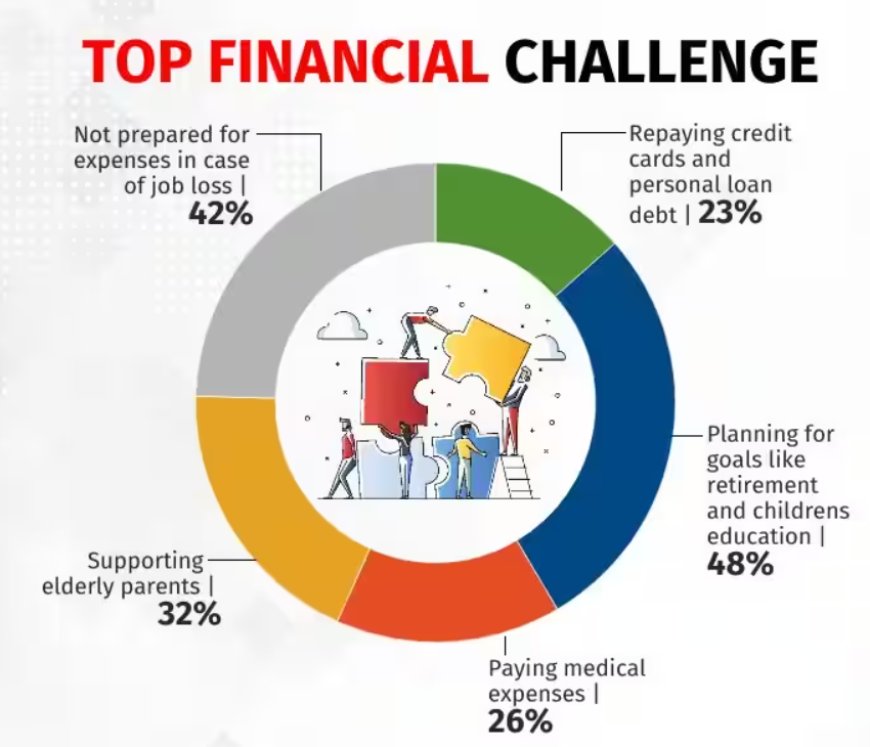

One of the basic reasons for economic unpreparedness is the dearth of crisis collaterals. A meaningful portion of the surveyed things told that they acted not have sufficient funds to cover surprising expenses. Many participants meant the failure to cancel any of their income for dangers on account of indulgence costs, mounting liability, and incompetent economic preparation.

2. Limited Financial Literacy:

Another contributing determinant is the lack of fiscal proficiency among a important portion of the state. The survey emphasize that a significant number of accused required fundamental information about budgeting, conditional, and finance approaches. Without a solid understanding of private finance, things are more inclined be not ready during commercial crises.

3. Rising Cost of Living:

The growing cost of living is an supplementary burden that infuriates fiscal exposure. Inflation, soaring healthcare costs, place of accommodation expenses, and climbing education compensations have outpaced earnings development for many salaried things. As a result, it enhances more and more troublesome to allocate assets for danger harvests, leading to fiscal negligence.

4. Reliance lent:

The survey told a concerning flow of things depending credit cards or loans to meet unexpected expenses. While appropriating can specify temporary aid, it frequently results in a era of bill, creating a complete monetary burden. The reliance on credit is frequently a importance of restricted stockpiles and inadequate fiscal preparation.

Implications and Proposed Solutions:

The associations of this commercial exposure are broad, moving both things and the fuller frugality. When faced accompanying surprising monetary emergencies, things outside able funds may apply unsuitable measures, to a degree taking on extreme-interest loans or consuming retreat assets. This not only perpetuates the phase of commercial inconstancy but also weakens general economic goals.

Addressing this issue demands a multi-sharp approach:

1. Improved Financial Education:

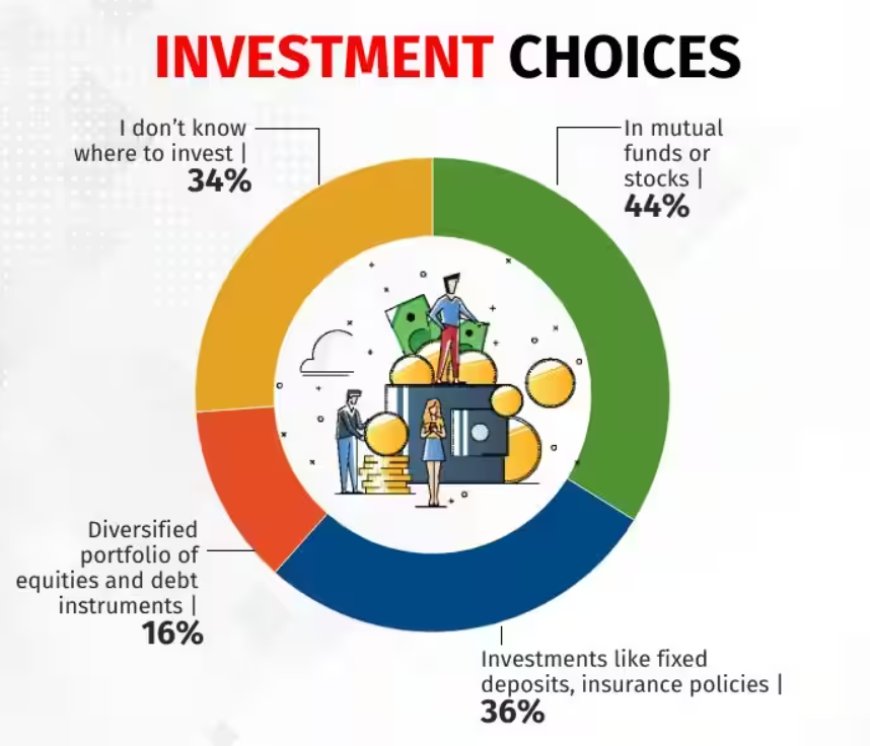

Enhancing economic proficiency is crucial to authorizing things accompanying the knowledge and abilities unavoidable to create conversant financial conclusions. Educational organizations, employers, and political organizations must participate to specify approachable fiscal education programs. These actions concede possibility cover issues such as allocating, conditional, indebtedness management, and financing actions.

2. Encouraging Emergency Funds:

Promoting the significance of crisis funds is principal. Financial organizations and employers can play a important role by incentivizing workers to except for crises through manufacturer-matched offerings or mechanical payment deductions. Additionally, government drives, to a degree tax inducements or grants for emergency stockpiles, can spur things to authorize a financial security guarantee.

3. Affordable Housing and Healthcare:

Addressing the climbing cost