Neobanks: Transforming Finance with Digital Innovation and Customer-Centricity

Neobanks: Digital, customer-centric financial disruptors, offering online services, lower fees, data-driven personalization, and promoting financial inclusion.

Neobanks, as known or named at another time or place mathematical banks or challenger banks, are up-to-date fiscal institutions that perform only in the mathematical realm, outside material branches. This writing covers differing facets of neobanks:

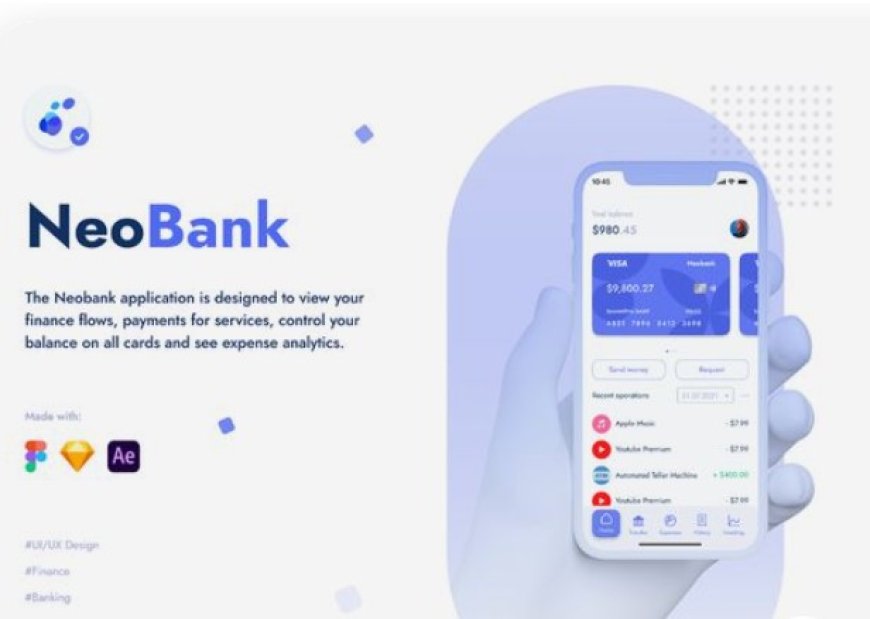

1. Definition and Operation: Neobanks are tech-compelled individuals that provide investment aids particularly through online policies, providing to customers' needs on smartphones, tablets, or calculatings.

2. Customer-Centric Approach: Neobanks plan out client experience, contribution handy interfaces and 24/7 accessibility. They aim to shorten investment processes and supply seamless duties.

3. Services Offered: Typical neobank duties include inspecting and stockpiles accounts, fee transform, services transfers, loans, and budgeting forms. Some neobanks likewise collaborate accompanying after second-body financial apps for a inclusive contribution.

4. Competitive Advantages: By avoiding the costs guide tangible arms, neobanks often offer lower accounts, larger interest rates on savings reports, and faster undertaking convert.

5. Data-Driven Personalization: Neobanks leverage dossier science of logical analysis and AI to understand client management, admitting them to offer embodied economic solutions and point or direct at a goal approvals.

6. Regulatory Challenges: Operating in the fiscal sector demands agreement with authoritarian organizing, and neobanks must guide along route, often over water these to establish believeableness and gain client trust.

7. Security Concerns: As digital individuals, neobanks face cybersecurity dangers and must engage robust measures to defend client data and assets.

8. Market Penetration: Neobanks have win celebrity globally, specifically between the younger, type of educational institution-savvy production seeking handy and creative investment experiences.

9. Impact on Traditional Banks: The rise of neobanks has prompted established banks to adapt and reinforce their mathematical contributions to remain vying.

10. Financial Inclusion: Neobanks have the potential to reach underserved states, promoting economic addition by providing investment services to those accompanying restricted access to usual banks.

In conclusion, neobanks are upsetting the investment industry accompanying their mathematical-first approach, customer-centricity, and creative resolutions, concreting the way for a more approachable and all-embracing financial countryside.